Introduction

The goal of mcrutils is to provide a grab-bag of utility

functions that I find useful in my own R projects for data cleaning,

analysis, and reporting, including creating and visualizing year-to-date

and quarterly analyses, and customer account status/churn analysis.

Cleaning

Normalize logical columns

For data frames or tibbles that have character or factor columns

storing logical data, as may happen when reading from a database, CSV,

or Excel file, use normalize_logicals() to find and convert

these columns to logical type. This is a nice one-liner in a

dplyr pipe

library(dplyr, warn.conflicts = FALSE)

ugly_data <- tibble(

logical_char = c("T", "F", "T"),

logical_factor = factor(c("TRUE", "FALSE", "TRUE")),

non_logical_char = c("a", "b", "c"),

non_logical_factor = factor(c("x", "y", "z")),

mixed_char = c("T", "F", "a"),

mixed_factor = factor(c("TRUE", "FALSE", "x")),

numeric_col = c(1.1, 2.2, 3.3)

)

ugly_data

#> # A tibble: 3 × 7

#> logical_char logical_factor non_logical_char non_logical_factor mixed_char

#> <chr> <fct> <chr> <fct> <chr>

#> 1 T TRUE a x T

#> 2 F FALSE b y F

#> 3 T TRUE c z a

#> # ℹ 2 more variables: mixed_factor <fct>, numeric_col <dbl>

df <- ugly_data |> normalize_logicals()

#> Converted "logical_char" and "logical_factor" columns to

#> logical.

df

#> # A tibble: 3 × 7

#> logical_char logical_factor non_logical_char non_logical_factor mixed_char

#> <lgl> <lgl> <chr> <fct> <chr>

#> 1 TRUE TRUE a x T

#> 2 FALSE FALSE b y F

#> 3 TRUE TRUE c z a

#> # ℹ 2 more variables: mixed_factor <fct>, numeric_col <dbl>Analysis

Customer account status, churn, and retention

accounts_by_status() categorizes accounts into statuses

based on their order activity (active, new, returning, temporarily lost,

regained and terminally lost) in each time interval (monthly, weekly,

quarterly, etc. are supported). It also produces a running list of

cumulative accounts. This is useful for understanding customer retention

and churn.

The data.frame returned by

accounts_by_status() quickly gets unwieldy to print, so to

see how it works, let’s make a small example data set with a list of 25

orders from 10 accounts over 6 months.

set.seed(1234)

n <- 25

dates <- seq(as.Date("2022-01-01"), as.Date("2022-06-30"), by = "day")

orders <- data.frame(

account_id = sample(letters[1:10], n, replace = TRUE),

order_date = sample(dates, n, replace = TRUE)

) |> arrange(order_date)

orders |> glimpse()

#> Rows: 25

#> Columns: 2

#> $ account_id <chr> "h", "b", "b", "f", "d", "i", "e", "c", "d", "d", "j", "f",…

#> $ order_date <date> 2022-01-02, 2022-01-26, 2022-02-10, 2022-02-11, 2022-02-12…accounts_by_status() splits the order data by time

periods, and returns the accounts in each status category for each

period as a list-column.

orders |> accounts_by_status(account_id, order_date, by = "month")

#> period_start period_end active new returning

#> 1 2022-01-01 2022-01-31 b, h b, h

#> 2 2022-02-01 2022-02-28 b, c, d, e, f, i, j c, d, e, f, i, j b

#> 3 2022-03-01 2022-03-31 d, f d, f

#> 4 2022-04-01 2022-04-30 d, e, g, h g d

#> 5 2022-05-01 2022-05-31 e, f, h e, h

#> 6 2022-06-01 2022-06-30 f, j f

#> regained temporarily_lost terminally_lost cumulative

#> 1 b, h

#> 2 h b, h, c, d, e, f, i, j

#> 3 e, j b, c, i b, h, c, d, e, f, i, j

#> 4 e, h f b, h, c, d, e, f, i, j, g

#> 5 f d, g b, h, c, d, e, f, i, j, g

#> 6 j e, h b, h, c, d, e, f, i, j, gIf you want the count of accounts in each status category, set

with_counts = TRUE (the lists of account_ids are still

included, we just omit them from the printed output here).

orders |>

accounts_by_status(account_id, order_date, by = "month", with_counts = TRUE) |>

select(period_start, starts_with("n_"))

#> period_start n_active n_new n_returning n_regained n_temporarily_lost

#> 1 2022-01-01 2 2 0 0 0

#> 2 2022-02-01 7 6 1 0 1

#> 3 2022-03-01 2 0 2 0 2

#> 4 2022-04-01 4 1 1 2 1

#> 5 2022-05-01 3 0 2 1 0

#> 6 2022-06-01 2 0 1 1 0

#> n_terminally_lost n_cumulative

#> 1 0 2

#> 2 0 8

#> 3 3 8

#> 4 0 9

#> 5 2 9

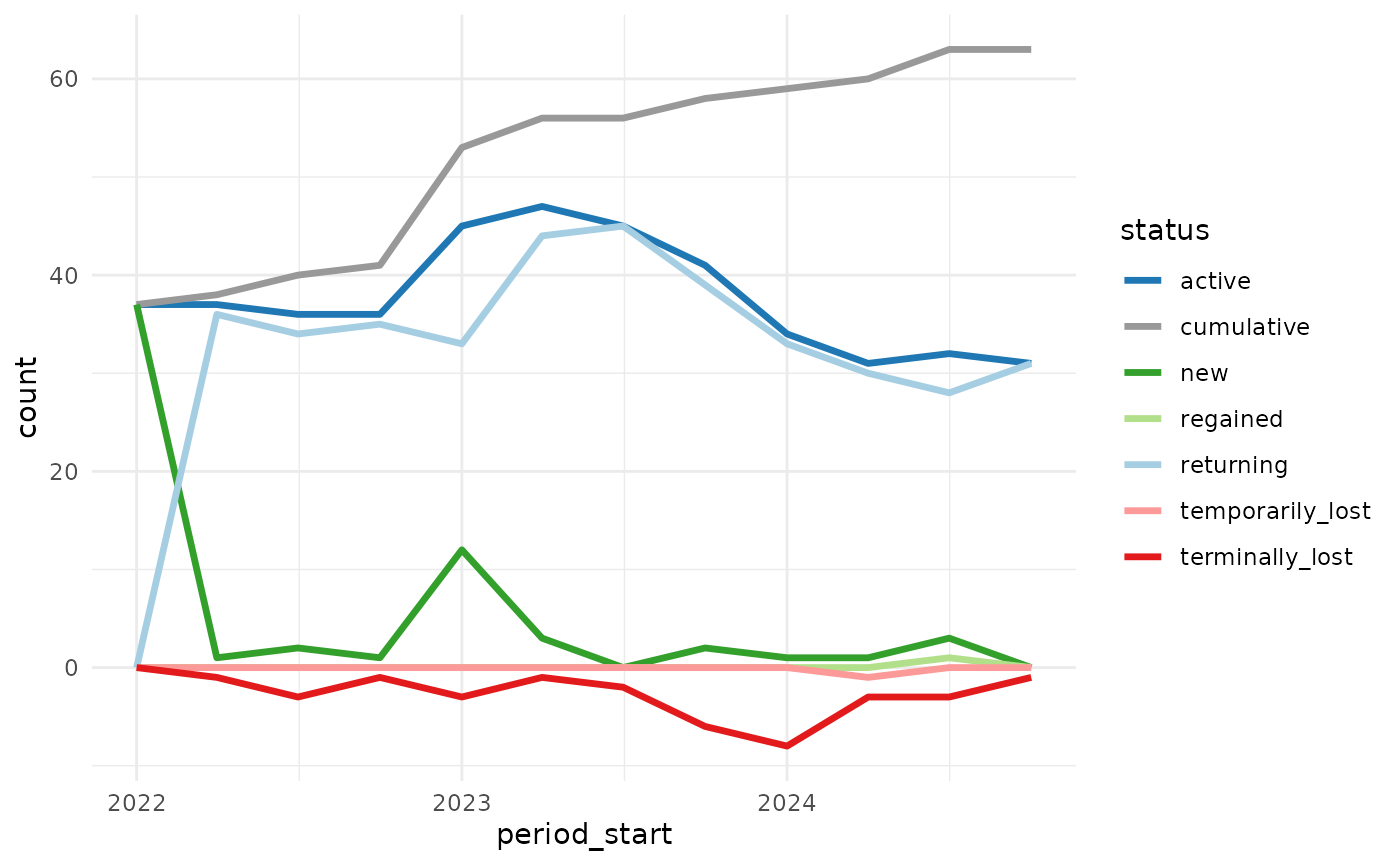

#> 6 2 9Visualizing the count of accounts in each status over time can be helpful to understand how the business is doing in terms of customer retention and churn.

mcrutils includes a larger example dataset

example_sales with about 5000 orders between accounts over

in the 2022–2024 time period.

example_sales |> glimpse()

#> Rows: 5,317

#> Columns: 4

#> $ account_id <chr> "l_10", "l_11", "l_20", "l_9", "l_1", "l_1", "l_18", "l_…

#> $ market <chr> "Germany", "Germany", "United States", "United States", …

#> $ order_date <date> 2022-01-02, 2022-01-03, 2022-01-03, 2022-01-03, 2022-01…

#> $ units_ordered <dbl> 1, 4, 2, 1, 3, 2, 2, 2, 1, 2, 3, 2, 2, 2, 2, 4, 4, 3, 1,…accounts_by_status() produces six status counts, plus

one cumulative count– that’s up to seven data series to plot, so we need

to be thoughtful about design choices.

Showing the lost accounts as a negative value helps de-clutter the picture and helps perception by encoding values above the axis as “good” and below as “bad” (assuming we don’t want to lose customers). We can use color to help as well (blues/greens: good, reds: bad).

library(ggplot2)

library(dplyr, warn.conflicts = FALSE)

library(tidyr)

example_sales |>

accounts_by_status(account_id, order_date, with_counts = TRUE, by = "quarter") |>

select(period_start, starts_with("n_")) |>

# negate the lost counts for visualization

mutate(across(contains("lost"), ~ -.x)) |>

# pivot to prepare for ggplot

pivot_longer(starts_with("n_"), names_to = "status", values_to = "count") |>

mutate(status = stringr::str_remove(status, "n_")) |>

ggplot(aes(period_start, count, color = status)) +

geom_line(linewidth = 1.2) +

scale_color_manual(values = c(

"active" = "#1f78b4",

"new" = "#33a02c",

"returning" = "#a6cee3",

"temporarily_lost" = "#fb9a99",

"terminally_lost" = "#e31a1c",

"regained" = "#b2df8a",

"cumulative" = "#999999"

)) +

theme_minimal()

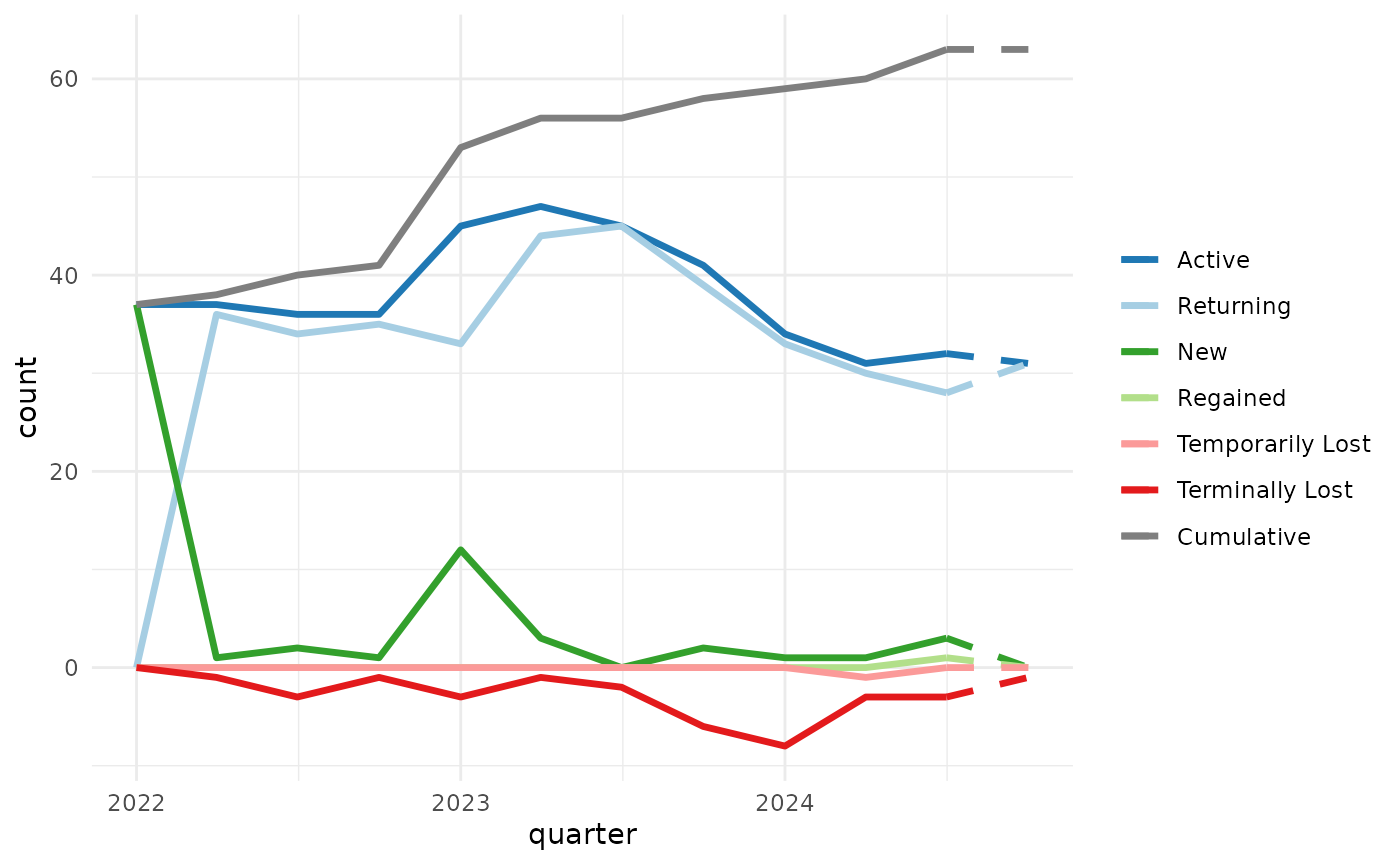

plot_accounts_by_status() is a convenience function that

does the above and a bit more, cleaning up the legend, x-axis title, and

if the last order_date is before the end of the final time period (as in

example_sales, which has no orders after 2024-12-20), the

final period will be shown with dashed lines to indicate that the data

may be incomplete.

example_sales |>

plot_accounts_by_status(account_id, order_date, by = "quarter")

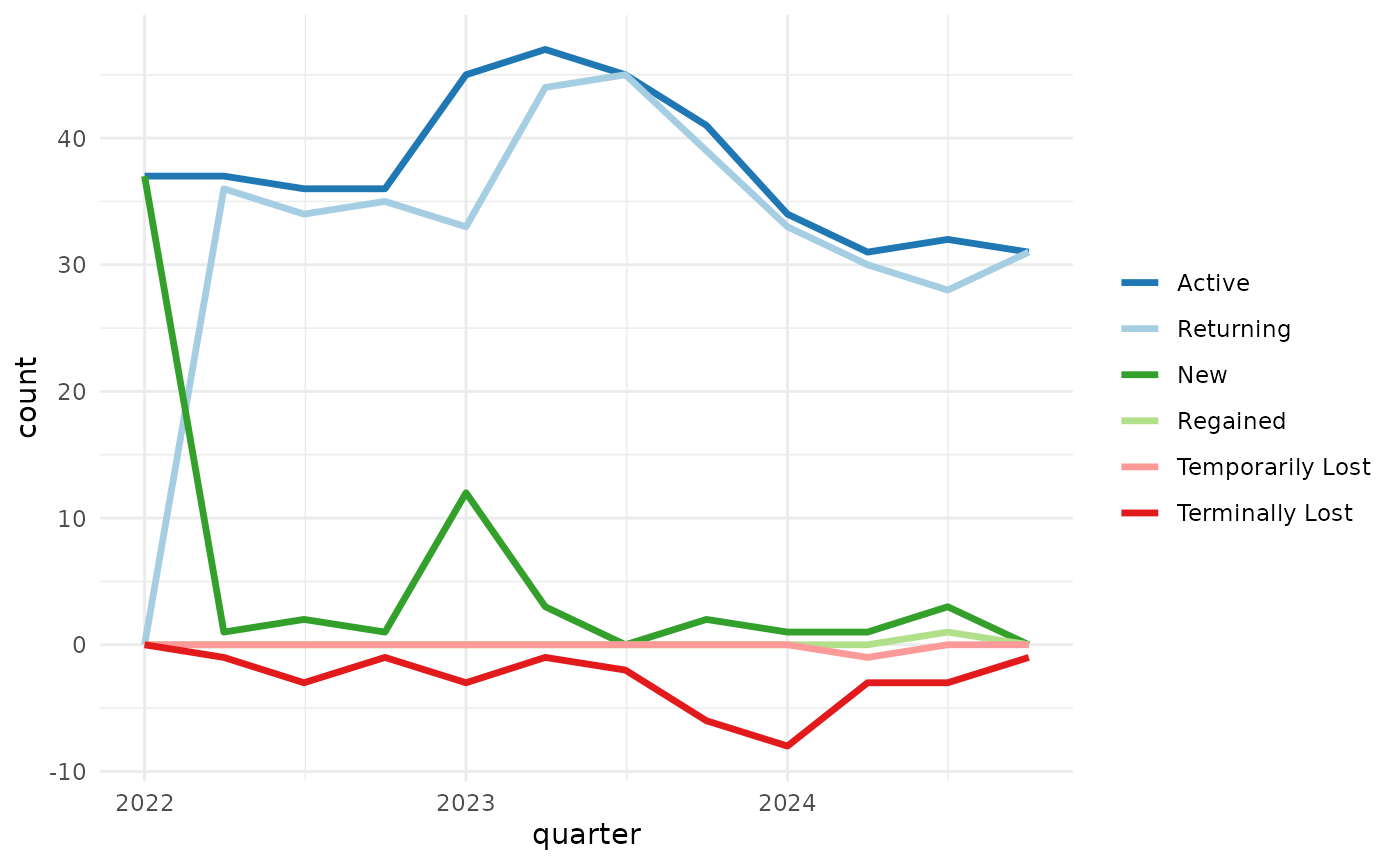

You can suppress the dashed lines for incomplete periods with with

force_final_period_complete = TRUE, and exclude the

cumulative line with include_cumulative = FALSE.

example_sales |>

plot_accounts_by_status(

account_id, order_date,

by = "quarter",

force_final_period_complete = TRUE,

include_cumulative = FALSE

)

CAGR

mutate_cagrs() adds columns with compound annual growth

rates (CAGRs) for a vector of values over specified time periods,

optionally grouped by one or more variables.

Here we’ll first aggregate the example_sales data to get

monthly sales volume by market, then use mutate_cagrs() to

calculate 1-, 2-, and 3-month CAGRs for each market.

library(lubridate, warn.conflicts = FALSE)

example_sales |>

group_by(

market,

month = lubridate::floor_date(order_date, unit = "month")

) |>

summarize(

volume = sum(units_ordered),

.groups = "drop_last"

) |>

mutate_cagrs(

volume,

month,

group_vars = market,

periods = c(1:3)

) |>

# peek at the first 4 rows for each market

slice_head(n=4, by = market)

#> # A tibble: 8 × 6

#> market month volume volume_cagr_1 volume_cagr_2 volume_cagr_3

#> <chr> <date> <dbl> <dbl> <dbl> <dbl>

#> 1 Germany 2022-01-01 64 NA NA NA

#> 2 Germany 2022-02-01 112 0.75 NA NA

#> 3 Germany 2022-03-01 71 -0.366 0.0533 NA

#> 4 Germany 2022-04-01 107 0.507 -0.0226 0.187

#> 5 United States 2022-01-01 206 NA NA NA

#> 6 United States 2022-02-01 232 0.126 NA NA

#> 7 United States 2022-03-01 185 -0.203 -0.0523 NA

#> 8 United States 2022-04-01 226 0.222 -0.0130 0.0314Business day evaluation

mcrutils provides several functions for working with

business days, including is_bizday(),

adjust_to_bizday(), bizdays_between(),

periodic_bizdays(), and

bizday_of_period().

These functions use calendars from QuantLib for working/non-working

day definitions, and they are all based on the qlcal

package. In fact, with the exception of periodic_bizdays(),

there are corresponding functions in qlcal.

The motivation for the mcrutils versions was to

facilitate frequent changes to the configured QuantLib calendar without

making persistent changes to the globally configured calendar,i.e. these

functions contain the calendar change to their own functional scope.

This functionality leverages withr.

mcrutils also provides with_calendar() and

local_calendar() functions so you can leverage this

side-effect encapsulation for other qlcal use cases.

Business days in periodic intervals

periodic_bizdays() calculates the number of business

days in each periodic interval (e.g., monthly, quarterly) between two

dates, using calendars from QuantLib for holiday definitions.

periodic_bizdays(

from = "2025-01-01",

to = "2025-12-31",

by = "quarter",

quantlib_calendars = c("UnitedStates", "UnitedKingdom")

)

#> # A tibble: 8 × 4

#> calendar start end business_days

#> <chr> <date> <date> <int>

#> 1 UnitedStates 2025-01-01 2025-03-31 61

#> 2 UnitedStates 2025-04-01 2025-06-30 63

#> 3 UnitedStates 2025-07-01 2025-09-30 64

#> 4 UnitedStates 2025-10-01 2025-12-31 62

#> 5 UnitedKingdom 2025-01-01 2025-03-31 63

#> 6 UnitedKingdom 2025-04-01 2025-06-30 61

#> 7 UnitedKingdom 2025-07-01 2025-09-30 65

#> 8 UnitedKingdom 2025-10-01 2025-12-31 64Cumulative daily sales by business day of period

bizday_of_period() calculates the business day of the

period (month, quarter, or year) for a given date and calendar e.g. date

x is the 3rd business day of the month.

This can be helpful in creating an apples-to-apples “burn-up” chart showing cumulative orders, revenue, etc through the period vs. a similar period in a prior year.

When there are multiple records per day, it’s generally faster to create a lookup table from date to business day of period, and then join that to your data frame.

Using the example_sales dataset, first we add a column

with the QuantLib calendar to be used for each order (in this case the

market column is close, we just need to eliminate the space in “United

States”).

library(dplyr, warn.conflicts = FALSE)

library(purrr)

library(stringr)

sales <- example_sales |>

mutate(calendar = str_replace_all(market, " ", ""))

head(sales)

#> # A tibble: 6 × 5

#> account_id market order_date units_ordered calendar

#> <chr> <chr> <date> <dbl> <chr>

#> 1 l_10 Germany 2022-01-02 1 Germany

#> 2 l_11 Germany 2022-01-03 4 Germany

#> 3 l_20 United States 2022-01-03 2 UnitedStates

#> 4 l_9 United States 2022-01-03 1 UnitedStates

#> 5 l_1 Germany 2022-01-04 3 Germany

#> 6 l_1 Germany 2022-01-04 2 GermanyNow we can make a lookup table covering the years and markets in our data set.

bizday_lookup <- tibble(

# make a row for each date in the years spanned by the sales data

date = seq(

from = lubridate::floor_date(min(sales$order_date), "month"),

to = lubridate::ceiling_date(max(sales$order_date), "month") - 1,

by = "day"

)

) |>

# cross with each calendar

tidyr::expand_grid(calendar = unique(sales$calendar)) |>

mutate(

adjusted_date = purrr::map2_vec(

.data$date, .data$calendar,

\(date, calendar) adjust_to_bizday(date, calendar)

),

# calculate the business day of month for each date in each market

bizday_of_month = purrr::pmap_int(

list(adjusted_date, .data$calendar),

\(date, calendar) {

bizday_of_period(date, calendar, period = "month")

}

),

# and again for the business day of quarter

bizday_of_quarter = purrr::pmap_int(

list(adjusted_date, .data$calendar),

\(date, calendar) {

bizday_of_period(date, calendar, period = "quarter")

}

)

)

# peek at the result

bizday_lookup |>

filter(date >= ymd("2023-07-02")) |> # starting on a Sunday in July

head()

#> # A tibble: 6 × 5

#> date calendar adjusted_date bizday_of_month bizday_of_quarter

#> <date> <chr> <date> <int> <int>

#> 1 2023-07-02 Germany 2023-07-03 1 1

#> 2 2023-07-02 UnitedStates 2023-07-03 1 1

#> 3 2023-07-03 Germany 2023-07-03 1 1

#> 4 2023-07-03 UnitedStates 2023-07-03 1 1

#> 5 2023-07-04 Germany 2023-07-04 2 2

#> 6 2023-07-04 UnitedStates 2023-07-05 2 2Now we can join the lookup table to the sales data.

sales_with_bizday <- sales |>

left_join(bizday_lookup, by = c("order_date" = "date", "calendar" = "calendar"))

head(sales_with_bizday)

#> # A tibble: 6 × 8

#> account_id market order_date units_ordered calendar adjusted_date

#> <chr> <chr> <date> <dbl> <chr> <date>

#> 1 l_10 Germany 2022-01-02 1 Germany 2022-01-03

#> 2 l_11 Germany 2022-01-03 4 Germany 2022-01-03

#> 3 l_20 United States 2022-01-03 2 UnitedStates 2022-01-03

#> 4 l_9 United States 2022-01-03 1 UnitedStates 2022-01-03

#> 5 l_1 Germany 2022-01-04 3 Germany 2022-01-04

#> 6 l_1 Germany 2022-01-04 2 Germany 2022-01-04

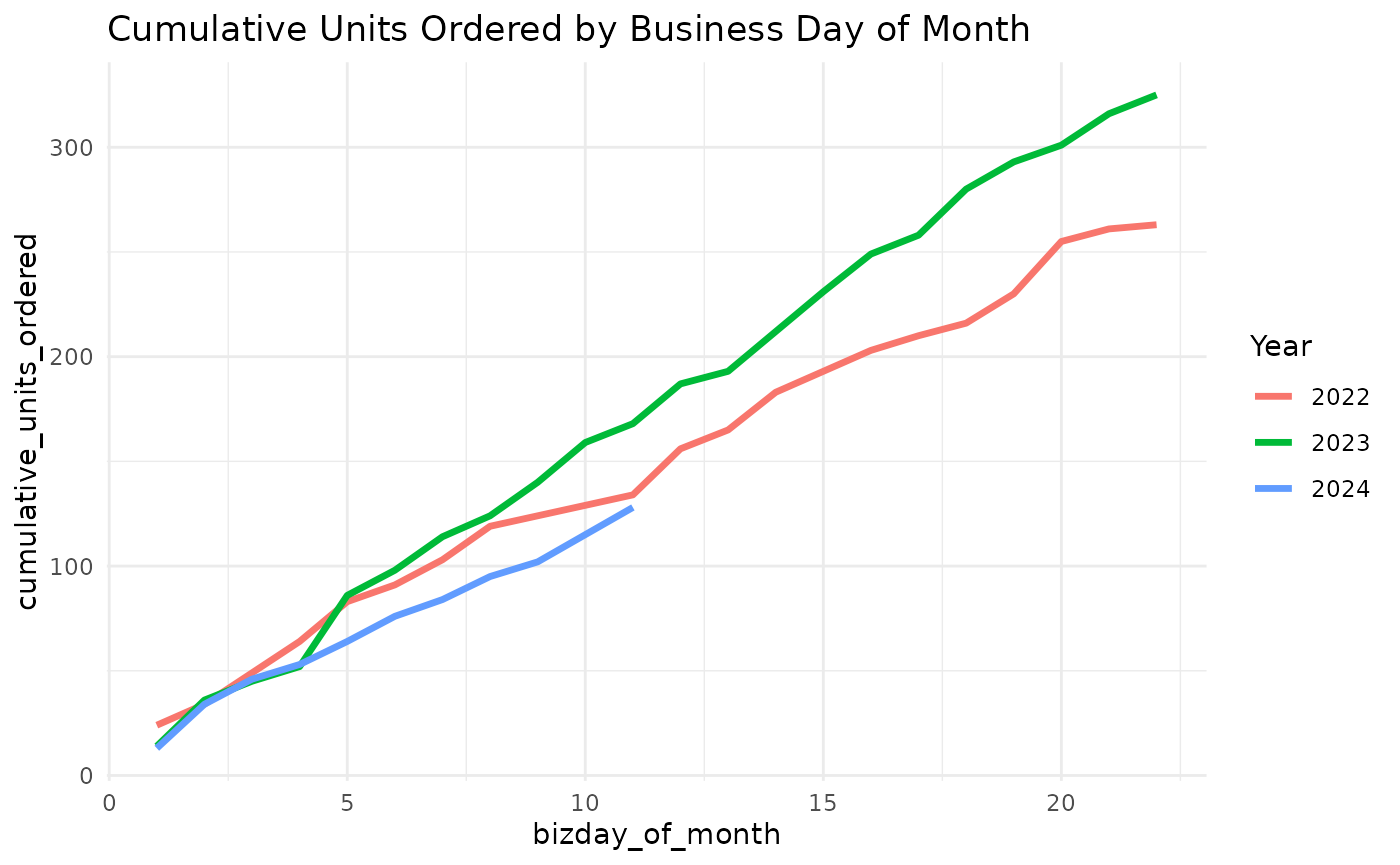

#> # ℹ 2 more variables: bizday_of_month <int>, bizday_of_quarter <int>Let’s imagine it’s mid-November 2024, and we want to see how orders are tracking against the prior year.

First we group by the year and business day of month, then calculate daily units ordered and the cumulative sum of units ordered

global_cum_daily_sales <- sales_with_bizday |>

filter(order_date < ymd("2024-11-18")) |>

filter(month(adjusted_date) == 11) |>

group_by(year = year(adjusted_date), bizday_of_month) |>

summarise(units_ordered = sum(units_ordered), .groups = "drop") |>

group_by(year) |>

mutate(cumulative_units_ordered = cumsum(units_ordered))

head(global_cum_daily_sales)

#> # A tibble: 6 × 4

#> # Groups: year [1]

#> year bizday_of_month units_ordered cumulative_units_ordered

#> <dbl> <int> <dbl> <dbl>

#> 1 2022 1 24 24

#> 2 2022 2 10 34

#> 3 2022 3 15 49

#> 4 2022 4 15 64

#> 5 2022 5 19 83

#> 6 2022 6 8 91Now we can construct a cumulative daily sales chart comparing 2024 to prior years.

global_cum_daily_sales |>

ggplot(aes(bizday_of_month, cumulative_units_ordered, color = factor(year))) +

geom_line(linewidth = 1.2) +

labs(

title = "Cumulative Units Ordered by Business Day of Month",

color = "Year"

) +

theme_minimal()

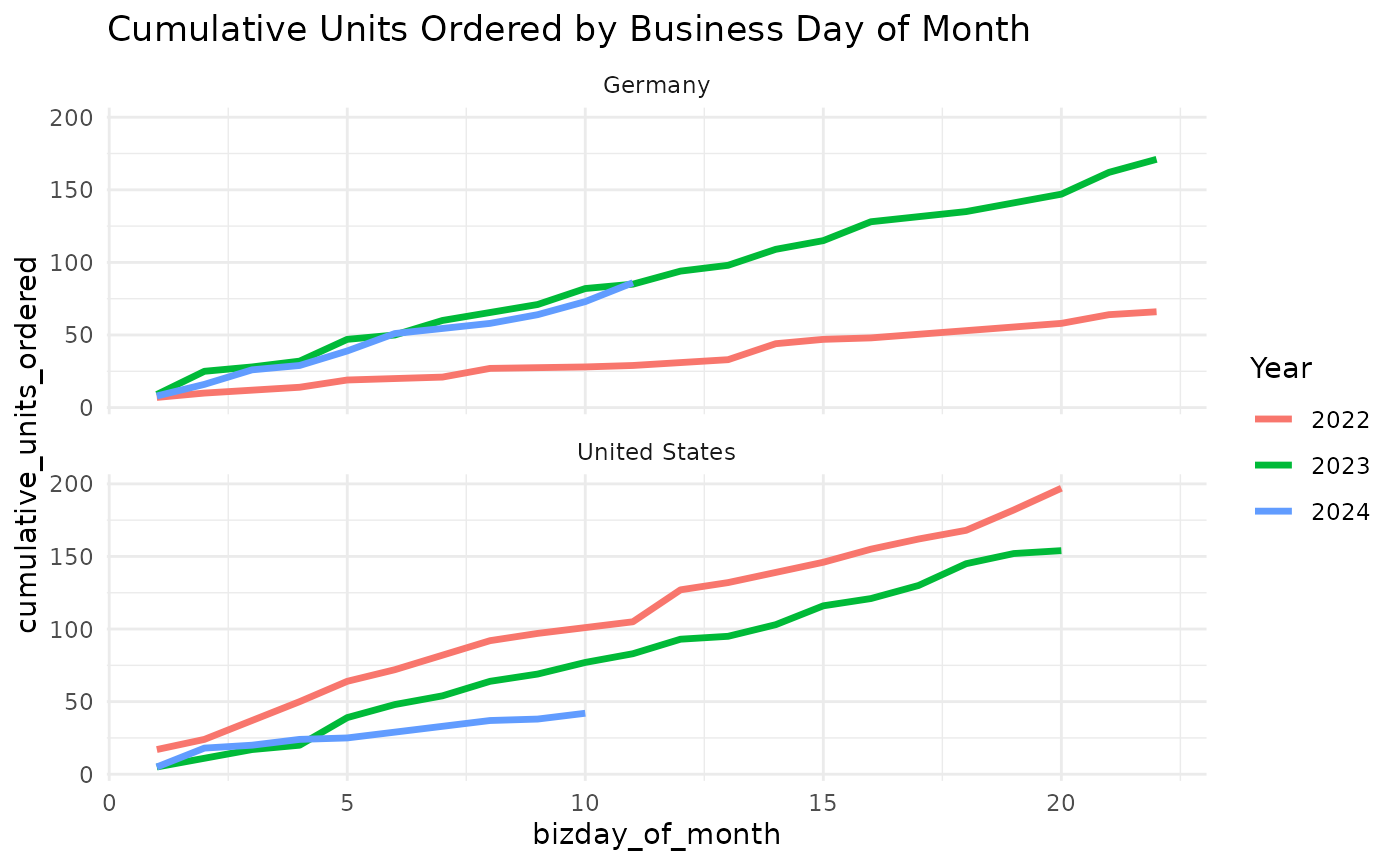

Or we can look by-market as well, we just need to add another grouping variable for the market, then facet the plot.

regional_cum_daily_sales <- sales_with_bizday |>

filter(order_date < ymd("2024-11-18")) |>

filter(month(order_date) == 11) |>

group_by(year = year(order_date), bizday_of_month, market) |>

summarise(units_ordered = sum(units_ordered), .groups = "drop") |>

group_by(year, market) |>

mutate(cumulative_units_ordered = cumsum(units_ordered))

head(regional_cum_daily_sales)

#> # A tibble: 6 × 5

#> # Groups: year, market [2]

#> year bizday_of_month market units_ordered cumulative_units_ordered

#> <dbl> <int> <chr> <dbl> <dbl>

#> 1 2022 1 Germany 7 7

#> 2 2022 1 United States 17 17

#> 3 2022 2 Germany 3 10

#> 4 2022 2 United States 7 24

#> 5 2022 3 Germany 2 12

#> 6 2022 3 United States 13 37

regional_cum_daily_sales |>

ggplot(aes(bizday_of_month, cumulative_units_ordered, color = factor(year))) +

geom_line(linewidth = 1.2) +

facet_wrap(~market, ncol=1) +

labs(

title = "Cumulative Units Ordered by Business Day of Month",

color = "Year"

) +

theme_minimal()

Year-to-date helpers

mcrutils provides a handful functions that can be

helpful in creating year-to-date analyses

Below we have 2.5 years of historical sales data ending on June 1, 2025.

set.seed(123)

sales <- tibble(

date = seq(

from = as.Date("2023-01-01"),

to = as.Date("2025-06-01"),

by = "month"

),

amount = rpois(30, lambda = 100)

)

head(sales)

#> # A tibble: 6 × 2

#> date amount

#> <date> <int>

#> 1 2023-01-01 94

#> 2 2023-02-01 111

#> 3 2023-03-01 83

#> 4 2023-04-01 101

#> 5 2023-05-01 117

#> 6 2023-06-01 104ytd_bounds() gets the start and end of the year-to-date

period for the latest year in a vector of dates,

(bounds <- ytd_bounds(sales$date))

#> [1] "2025-01-01" "2025-06-01"and is_ytd_comparable() is a logical vector that

indicates whether the dates in a vector are within a year-to-date period

relative to a given end_date.

So we can quickly filter the historical data to see how we’re doing in 2025 compared to the same period (i.e. January - June) in 2023 and 2024:

sales |>

filter(is_ytd_comparable(date, max(bounds))) |>

group_by(year = lubridate::year(date)) |>

summarise(ytd_sales = sum(amount))

#> # A tibble: 3 × 2

#> year ytd_sales

#> <dbl> <int>

#> 1 2023 610

#> 2 2024 594

#> 3 2025 600With py_dates() you can rollback a vector of dates to

the same period in the previous year, moving any fictitious dates to the

prior valid day.

Visualization

Auto-formatted datattables

auto_dt() uses guess_col_fmts() to

determine the format of each column. You can provide

pct_flags and curr_flags (character vectors)

if you need to control the list of “signal” words that indicate a column

is a percentage or currency.

You can suppress the buttons for copy, csv, and excel downloads with

buttons = FALSE.

tribble(

~product, ~weight, ~dollaz_earned, ~growth_pct,

"Widget A", 13.53, 1023.21, 0.051,

"Widget B", 22.61, 150.24, 0.103,

"Widget C", 40.54, 502.26, 0.021,

"Widget D", 34.21, 2000.95, 0.154

) |>

mutate(product = as.factor(product)) |>

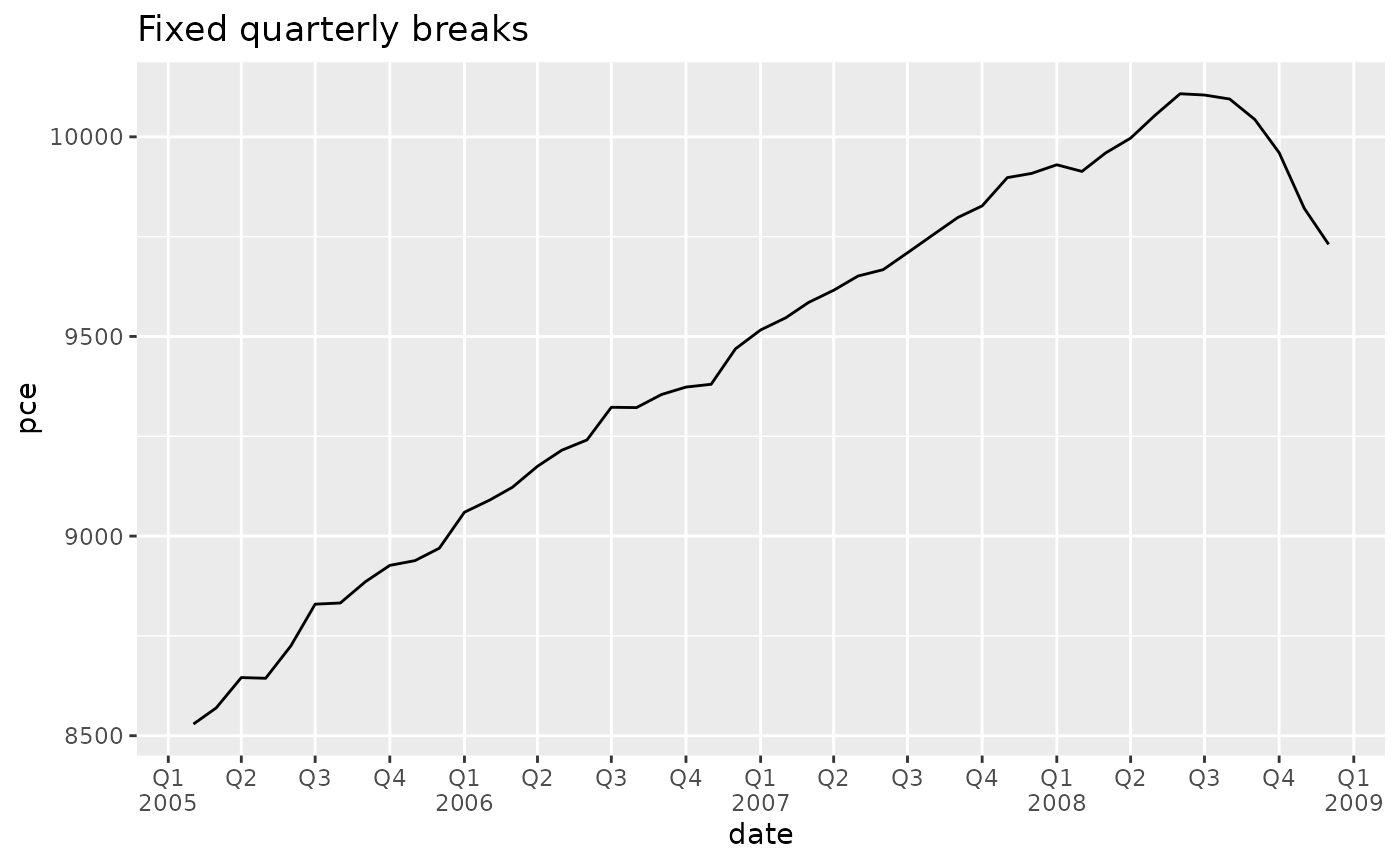

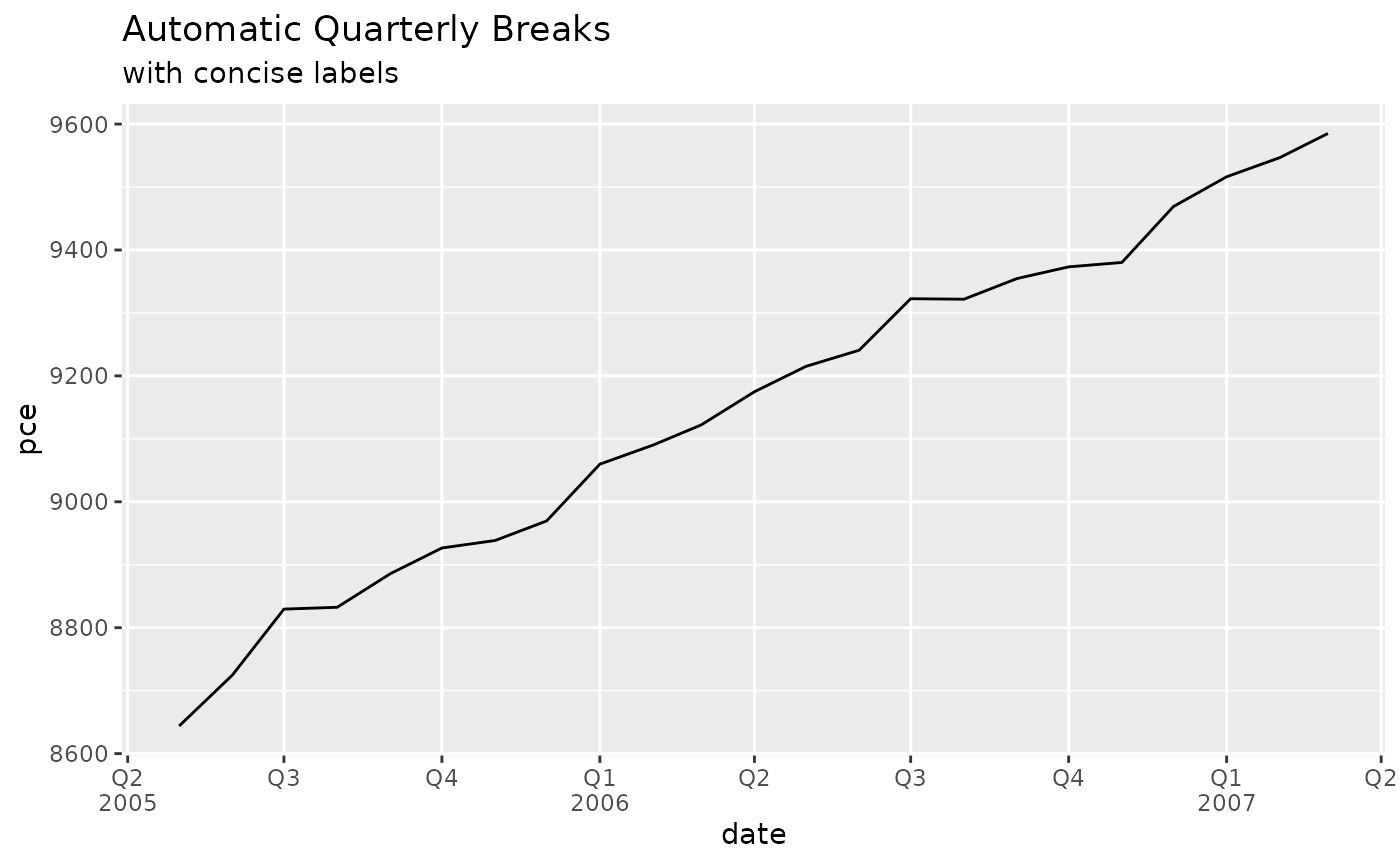

auto_dt(numeric_digits = 1, pct_digits = 0, curr_flags = c("revenue", "dollaz"))Quarterly breaks and labels

scales::label_date_short() is a great function for

labeling dates in ggplot2, but unfortunately it can’t

support quarterly breaks and labels out of the box.

mcrutils provides a set of functions to create quarterly

breaks and labels for date scales in ggplot2. The

breaks_quarters() function generates breaks for quarters,

and label_quarters_short() generates minimal labels for

these breaks in a two-line format (like

scales::label_date_short()), labeling every quarter, but

only including the year when it changes from the previous label.

library(ggplot2)

economics |>

filter(date >= "2005-05-01", date <= "2007-03-01") |>

ggplot(aes(date, pce)) +

geom_line() +

scale_x_date(

breaks = breaks_quarters(),

labels = label_quarters_short()

) +

labs(

title = "Automatic Quarterly Breaks",

subtitle = "with concise labels"

) +

theme(panel.grid.minor.x = element_blank())

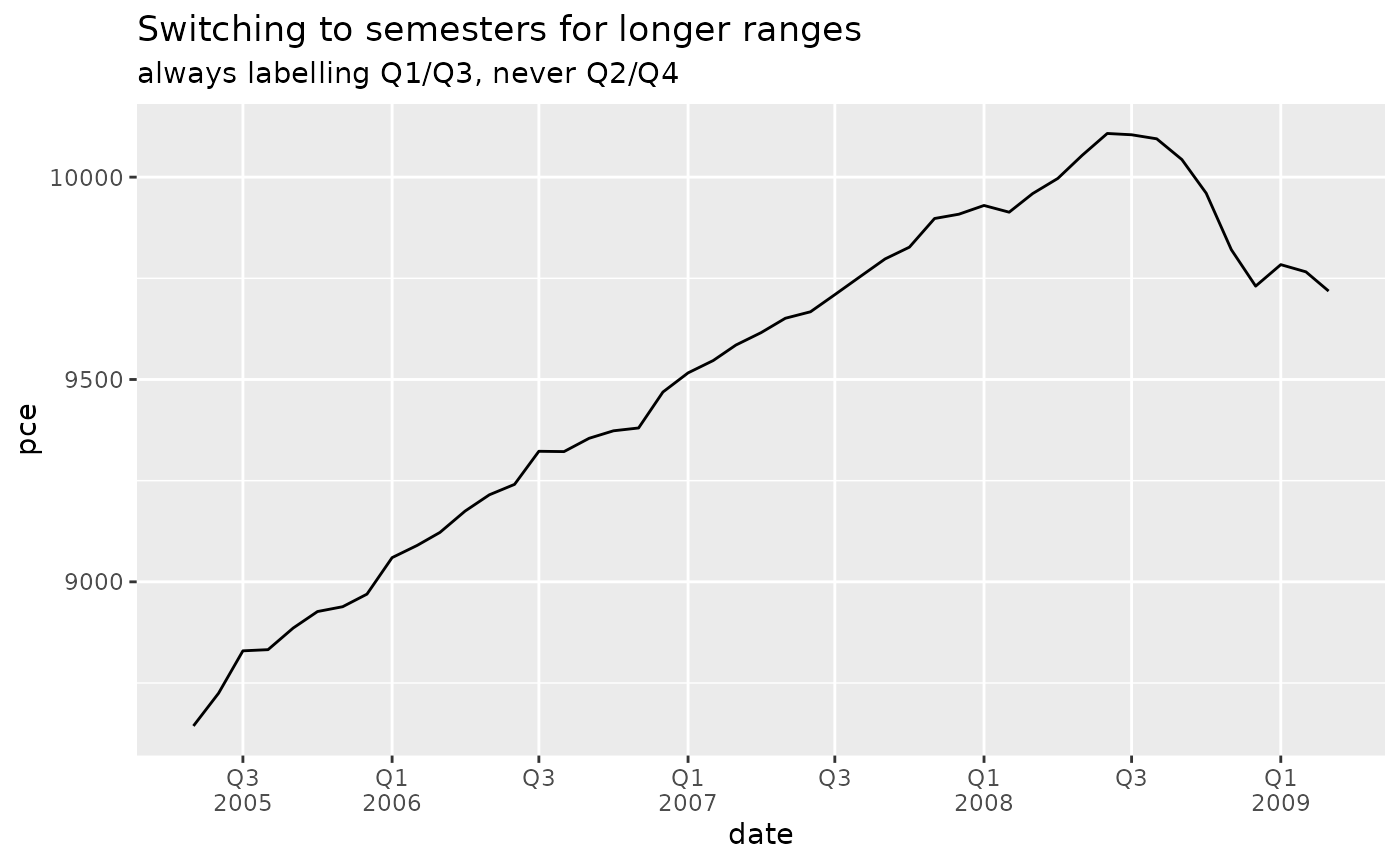

The automatic version of breaks_quarters() tries to

return a reasonable number of breaks over a wide range of dates,

down-sampling to semesters and years as needed.

economics |>

filter(date >= "2005-05-01", date <= "2009-03-01") |>

ggplot(aes(date, pce)) +

geom_line() +

scale_x_date(

breaks = breaks_quarters(),

labels = label_quarters_short()

) +

labs(

title = "Switching to semesters for longer ranges",

subtitle = "always labelling Q1/Q3, never Q2/Q4"

) +

theme(panel.grid.minor.x = element_blank())

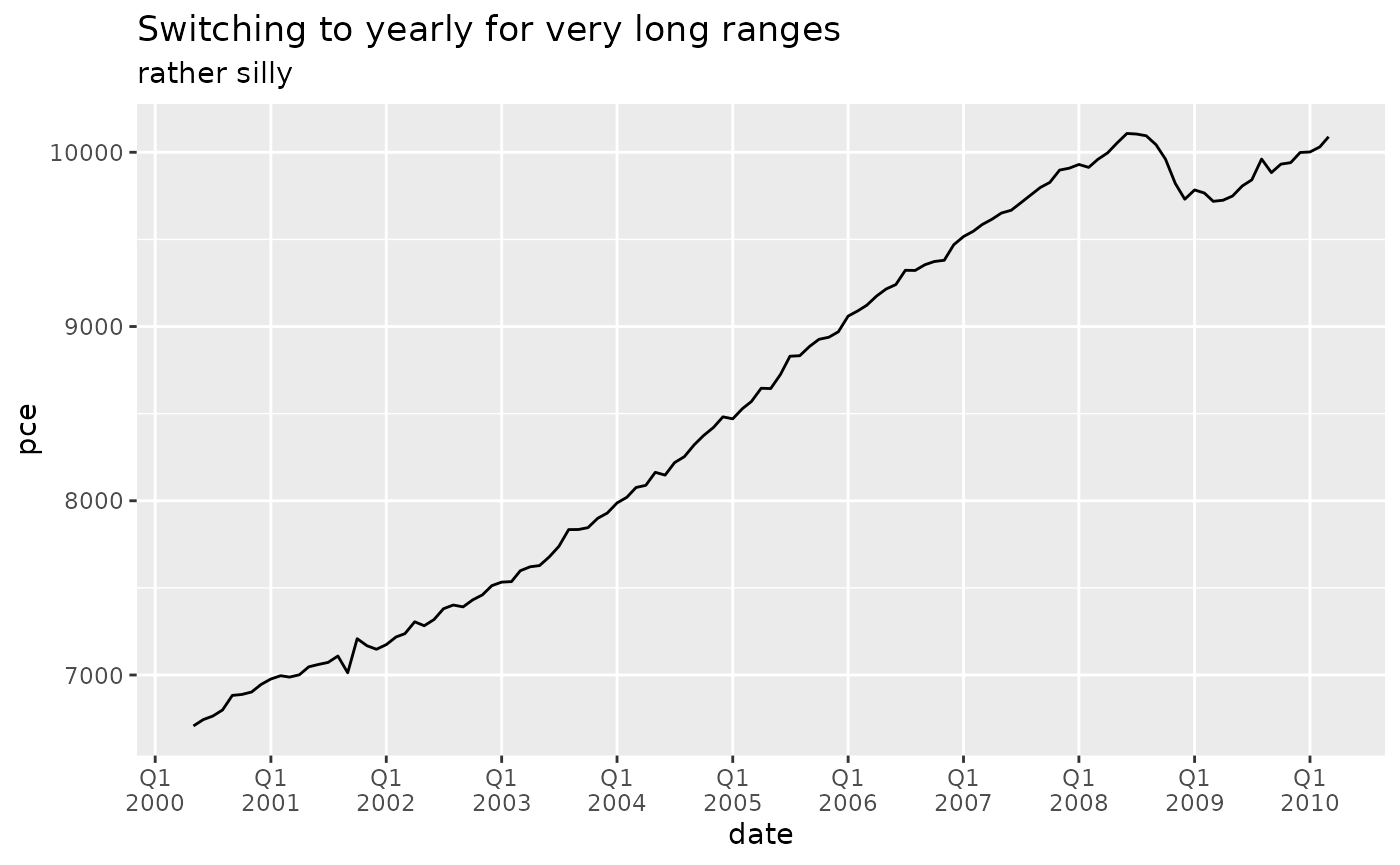

economics |>

filter(date >= "2000-05-01", date <= "2010-03-01") |>

ggplot(aes(date, pce)) +

geom_line() +

scale_x_date(

breaks = breaks_quarters(),

labels = label_quarters_short()

) +

labs(

title = "Switching to yearly for very long ranges",

subtitle = "rather silly"

) +

theme(panel.grid.minor.x = element_blank())

With very long date ranges like this, you are likely better off

switching from these quarterly functions to the more standard date

breaks and labels in ggplot2.

You can force a fixed break width if quarters are desired regardless of the date range.

example_sales |>

plot_accounts_by_status(account_id, order_date, by = "quarter") +

scale_x_date(

breaks = breaks_quarters(width = "1 quarter"),

labels = label_quarters_short()

) +

theme(panel.grid.minor.x = element_blank())